What Happen Car No Road Tax Malaysia

First avoid the JPJ Police Roadblock. RM050 progressive rate x 200 RM100.

Road Tax Expired Penalty Malaysia Is There Really A Penalty

Without car insurance you will not be able to renew your vehicles road tax from Road Transport Department JPJ MalaysiaDriving without a valid road tax can cost you.

. Road Tax for Public Transport JPJ. Prepare a copy of your bank statements verified and stamped by. The last publically available information regarding road tax revenue collected by JPJ was for 2018 when then Transport Minister.

So without car insurance you wont be able to renew your road tax through the Road Transport Department JPJ. For example with the above values in mind if your EV saloon has an rated output of 105kW 141hp you be paying a base rate of RM274 annually since it falls into the 100. The procedure to cancel your roadtax is as follows.

RM274 base rate Remaining 10kW. Car roadtax prices vary across cars. Road tax and car insurance are both obligatory for car owners to have.

The reason why the price of road tax in East Malaysia is cheaper than in West is because the infrastructure and the roads. First thing first youll need to send your carmotorcycle to PUSPAKOM office for an inspection. It is mandatory for every car owner in.

Prepare a copy of your identity card as the vehicle owner. Road tax is a tax fee paid annually by the owner of a vehicle used on the road. JPJ are clearly upping the squeeze here but it isnt anything too crazy yet.

So just browse their website or. Total road tax. And without your road tax you wont be allowed to drive on.

You might think that this is a bad idea but seriously no policeman is gung-ho enough to do a. The letter from the Road Transport Department JPJ is called Surat Pergerakan 3-hari. In line with the governments allocations under the Budget 2022 the Ministry of Transport Malaysia has announced that electric vehicles EV will be exempted from road tax starting 1.

Road charges are utilized for the countrywide. The figure doesnt include road tax. We share in this article the latest roadtax prices in Malaysia for a range of car brands and models.

Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak is in this link. We would like to show you a description here but the site wont allow us. Then you will need a letter from the Road Transport Department JPJ because now your vehicle is without a valid road tax and it is illegal to drive on the road without a valid road tax.

Book an appointment with PUSPAKOM. If your private car road tax has lapsed for less than a year in Malaysia you will not be subject to any penalties. However if your private automobile road tax has been expired for.

At minimum the road tax for an engine-driven car is RM20 for cars with engine displacements of 1000 cc and below. So this puts your car into the 100kW 125kW bracket for the road tax. To calculate the road tax of a vehicle the base rate and.

The bigger the vehicle the more charges are required to be paid. I propose that all senior citizens with valid driving license and owns a car should be given free road tax up to 2 liter cars and 70 discount from 2 to 299 liter cars. Travel during raining rush hour.

Between 16L and 30L road tax can range between RM200 to RM2130 per year.

Confirmed 4 Years Free Road Tax For Evs From 1 Jan 2022 To 31 Dec 2025 Wapcar

How Much Do You Know About Malaysian Road Tax Ezauto My

Evs Officially Exempted From Road Tax Until 2025 Oku Also Get Rebate For Modified National Ckd Vehicles Paultan Org

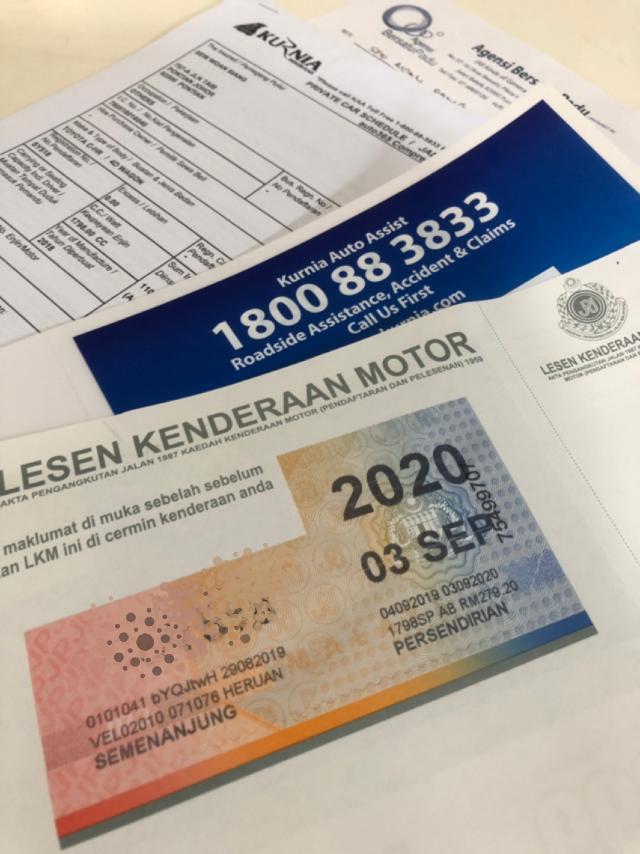

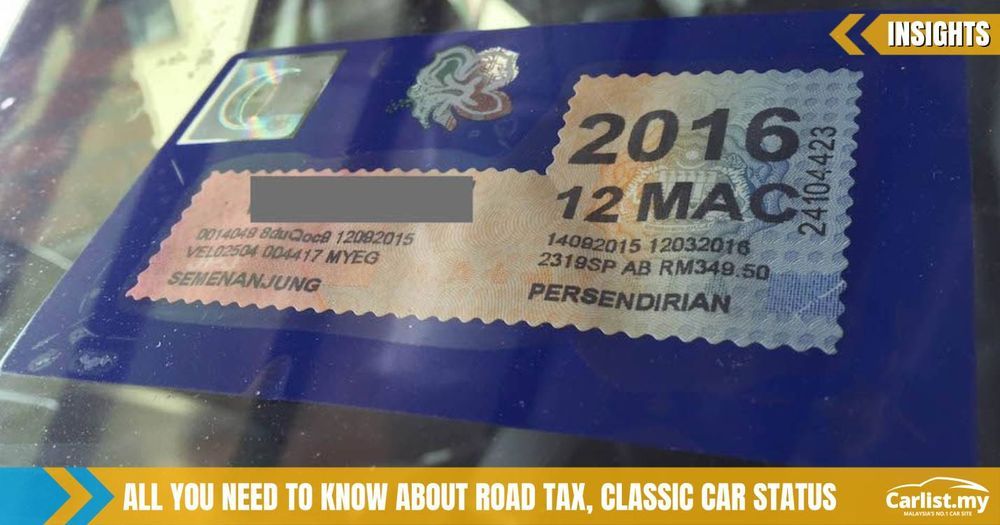

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Diy How To Stick Malaysia Road Tax Sticker To The Car Windscreen Car Rc

0 Response to "What Happen Car No Road Tax Malaysia"

Post a Comment